The email that caused a Snapchat employee to leak the company’s payroll data was likely requesting details about a US tax form known as "W2".

The attack against Snapchat was a novel take on the classic “business email compromise” (BEC) which relies on an email dressed up to appear as if it came from a senior exec, such as the CEO, to convince a subordinate with access to corporate bank accounts, such as a CFO, to initiate an urgent wire transfer to the attacker’s account.

The FBI in August warned that fewer than 10,000 businesses internationally lost $1.2 billion to BEC fraudsters between October 2013 and August 2015 and that victim reports had almost tripled since January 2015. In other words, the style of attack is on the rise and is costly to victims.

The Snapchat employee data leak, which occurred last Friday, is the first high profile case of a new twist to BEC. Snapchat said that the employee sent a phishing attacker an email that contained payroll information about some current and former employees.

However, Snapchat didn't reveal much about the attack other than it was a targeted and isolated email phishing scam that impersonated its CEO, Evan Spiegel.

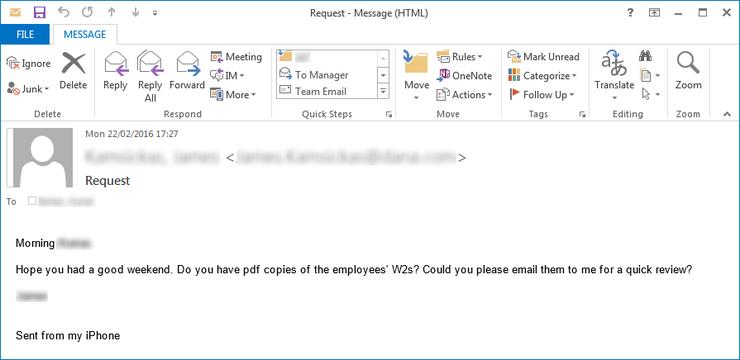

Symantec has shed light on what the Snapchat attack may have looked like to the employee who unwittingly leaked payroll data to attackers.

According to Symantec, on February 26, the day of Snapchat’s breach, one of the most prolific BEC scammers began sending out emails to junior members of accounting or human resource departments that request they send employee W2 tax forms.

The US Internal Revenue form, known as “Wage and Tax Statement”, includes wage and salary information, and taxes withheld.

“With these documents … the criminals would have everything they need to perform tax refund fraud; effectively stealing tax refunds owed to workers,” Symantec’s Security Response team said today.

The new style of BEC scam suggests attackers are looking at other avenues to monetise the scam, which has typically sought after big pay offs.

The attack group sent fewer than 40 W2 phishing emails on February 26 and raised it to just below 60 the next day. The group had sent out hundreds of class BEC emails in the week prior. In other words, both attacks are highly targeted compared to standard spam campaign.

The attackers use apparently stolen email accounts and create the appearance of matching the victim’s domain. Another trick employed by the group is to set the “Reply-to” header to automatically reply to an account under the attacker’s control as opposed to the spoofed sender address.

The key difference between standard BEC wire fraud and W2 fraud can be seen in the subject field, which in the latter case states there is a “Request For All Employees W2s”, possibly with a deadline tacked to it.

The FBI’s most recent update on BEC wire fraud from August outlines that there has been a 270 percent increase in identified victims and exposed loss since January 2015. The type of fraud has been reported in 50 US states and 79 countries.

Fraudulent transfers are going to 72 countries however this list dominated by transfers to banks in China and Hong Kong. The FBI notes that the attacks usually occur at the end of a business day or work week and are timed to coincide with the close of trading.

Microsoft is also attempting to tackle BEC threats through new security features introduced to Exchange Online in in January. As it noted, email spoofing is difficult to identify as malicious in traditional email filters, but the company claimed it had improved detection by over 500 percent by using a mix of signals.

Take this 5 minute survey on The State of Cloud Storage & Collaboration 2016 and go in the draw to win a $500 Visa credit card.